Upcoming Maintenance

Scheduled system maintenance will be at 12/28/2022 19:50 PST. The system will be unavailable for a few minutes at this time.

I’ve been experimenting with strategies that can make a real difference in monthly food spending, and in this article, I detail my early findings from an approach I dub “shelf use offsetting.” Using this strategy, I saved +25% in my first month compared to the average of five previous months. I’m continuing to gather data and future articles will offer more details.

The Problem

For someone who promotes using WizerFood to save money, I better be able to prove there’s some elements of its use that a) leads to behavioral changes that do save money over time, b) WizerFood makes this change easier than what might otherwise happen without it.

For me, having the tools was not the complete solution. I had to figure out how to use the tools properly to achieve my goals. I knew I wasn’t doing as well as I’d like with food spending by the time January 2023 rolled around. I took some steps to start understanding the scope of just how bad this was:

Shelf Use Offsetting

So, what to do? My plan in February was to make two important changes:

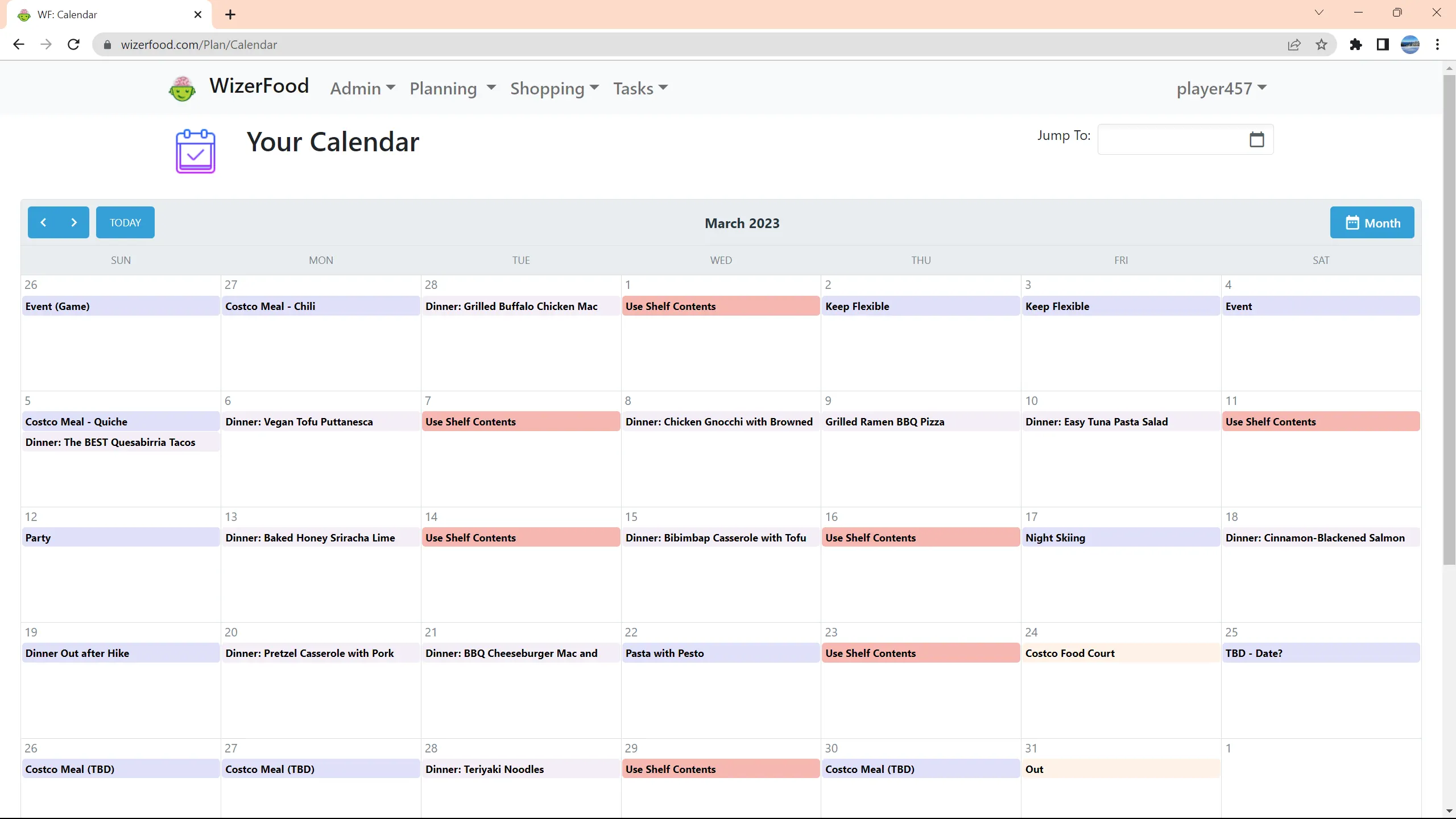

Here’s a look at what I entered for March, in late February:

What does “Use Shelf” really mean? First, it doesn’t have to mean “eat leftovers.” It might on any given night, but there are other options which achieve savings, too. For example, “use shelf” can mean, “use that carton of soup I bought five months ago, thinking I was going to use it but didn’t for any number of reasons… it’s still there on the shelf!” Or it could mean, “I’ve still got a package of pasta in my pantry that was part of a six-pack. Let me build a meal around that, using some tomato sauce similarly acquired, and some ground beef in the freezer… I’ll just wing together my own recipe based on the things I have.” The key is I’m drawing down things that might otherwise become future waste, even if not officially leftovers today. This also offers some flexibility: if I’m really not feeling like leftovers, there can be an “out,” but an out that still involves being efficient.

Looking at the March calendar example, I’ve got seven days I consider to be either “eating out” or in some other way, substantially spending on food that might be considered discretionary. (For example, the event on 3/4/23 is something I’m counting under a different explicit budget expense item.) I also have seven days for “Use Shelf Contents”: so, I’ve offset the number of days eating out.

Discussion

A lot of people don’t like leftovers, and I can be one of them, depending on what the food is. This is why for me, planning strategically is important since I can plan at least one leftover-friendly meal ahead of any “Use Shelf” event. Also, I’ve found that with pre-planning, I can “Use Shelf” on days that I know I want to be quick.

A key reason I believe shelf use offsetting works is that it’s forcing me to measure. I need to measure how often I’m opting for more expensive options. When plans need to change, I try to keep the offsetting, if possible. (Sometimes that won’t be possible, and that’s okay now-and-then if you return to your plan when feasible.)

Saying “just eat out less” is easy, but planning for it creates something actionable – and sometimes offers an excuse to not eat out. For example, when my wife says, “hey, I noticed that our favorite food truck is going to be at our local pub today” – I can say, “that’s okay: I’ve already got XYZ planned.” Getting buy-in from the whole family is important for success.

Creating a plan means you’re focusing on looking forward. Looking backward and reporting on your past performance can be interesting (as I covered here) – but it’s not leading to actions that need to be happening now. WizerFood supports both views – forward and backward. Seeing your current month’s trend and projected total food spending can help as well to guide smaller day-to-day choices. For example, if I’m trending poorly, maybe I’ll skip breakfast at the coffee shop and have a banana; but if I’m trending well, maybe I’ll treat myself to a nice lunch. (Rewarding yourself is great for reinforcing positive behavior!)

Another benefit beyond finances is I find that planning ahead helps guide towards healthier meal choices. I’m trying to cut down on red meat, and without paying attention to this – I’d be more likely to fail with it. Now I can slot in a few more vegetarian meals and my grocery list just updates automatically: one of the benefits of using WizerFood as the tool of choice here.

When you start tracking Food Spend using WizerFood, you won’t have historical data that allows populating “Stat of the Day” on the Dashboard page, where you could see your monthly food spending. However, “Points of Interest” on both the Calendar and Day Planner pages will contain some facts about Food Spend, even in your early days of use.

Tracking your food spending is very useful but not as important as planning actual meals, into the calendar. If you have a recipe in mind, you can add it to WizerFood, and then add it to your calendar. If the recipe is online, adding it to your calendar is very easy, as illustrated in this video:

WizerFood makes it easy to link to online recipe videos, too, as illustrated here:

There are different ways to plan, and there’s no single “right way.” I use the “Day Plan / Title” event type as a placeholder, or for cases which aren’t easily classified as a recipe or a restaurant visit – for example, going to a friend’s place to eat. If you have some uncertainty in your plan - for example, you know you’re going on a road-trip, and you know you’ll be eating out - I typically use “TBD” with an event type of “restaurant.” The key, really, is to be paying attention to the things that might be spiking your spending.

When I’ve completed my monthly plan, I’ll count the number of days that are “spend-heavy,” excluding grocery trips. This is the number that I use when making sure I’ve added an equal (or greater) number of “Use Shelf” events.

Results: How Did It Go?

February saw my food spend go down by more than 25%, compared to my five-month baseline. This is only one month of data, but it’s clear that it’s not only saving money, but I’m also keeping a cleaner fridge and throwing out less food. I’ll make future posts where I can discuss fine-tuning and long-term results.

Remember: it's not about deprivation… it’s about embracing planning as a solution to be more efficient, which in turn saves money – maybe a lot of money, depending on your starting point. For me, my goal is to cut food spending by at least $500 per month on average, over the long term. Over a year, that could pay for a nice trip to Hawaii! Keeping benefits like that in view can help keep you dedicated to planning as a strategy.

Final Thoughts

You might question: “I only spend a few hundred dollars on food per month, this won’t help me very much.” Even if finances aren’t your main concern, the other benefits are worth considering - like auto-generating your grocery list, getting alerts about what might be going bad in your fridge, tossing out less food, and so on.

For me, it’s undeniable that there are financial benefits. Living in an expensive market in the US, maybe it’s easier for someone like me to save more in absolute dollars, but 25% should be meaningful to almost everyone!

It also hasn’t felt “bad” – like I’m penalizing myself by forcing my family to eat more “shelf things” than we’re used to. Are we just arriving at a place everyone else is already at? I doubt it: the amount of food waste is (incredibly) estimated to be 30%-40% of the entire food supply, and that alone tells us that the “global we” need to strive for more efficiency.

There are other important behaviors that compliment the planning regiment of shelf use offsetting, including avoiding impulse buying during shopping, leveraging your freezer, and using up partly used ingredients. I’ll cover these topics in future articles. Till then, happy savings!

Remember: WizerFood is free, so there’s zero risk in trying it out! Here's a 3 minute video summary of this article: